How Ia Wealth Management can Save You Time, Stress, and Money.

Wiki Article

Fascination About Lighthouse Wealth Management

Table of ContentsTop Guidelines Of Private Wealth Management CanadaTax Planning Canada - TruthsHow Lighthouse Wealth Management can Save You Time, Stress, and Money.What Does Investment Representative Mean?The Best Strategy To Use For Financial Advisor Victoria BcAn Unbiased View of Financial Advisor Victoria Bc

“If you had been to buy a product or service, state a television or some type of computer, you might need to know the requirements of itwhat are the components and what it may do,” Purda explains. “You can contemplate purchasing economic guidance and assistance in the same manner. Individuals have to know what they are buying.” With monetary guidance, it is important to keep in mind that the merchandise isn’t securities, shares and other investments.It’s such things as budgeting, planning your retirement or reducing debt. And like getting a pc from a dependable organization, people need to know they are purchasing financial guidance from a reliable pro. Certainly Purda and Ashworth’s most fascinating findings is around the costs that monetary planners cost their customers.

This held correct irrespective the charge structurehourly, payment, assets under control or flat fee (from inside the learn, the buck worth of charges ended up being alike in each case). “It however boils down to the worth idea and doubt throughout the consumers’ component they don’t determine what these are generally getting back in trade for these fees,” says Purda.

The Facts About Private Wealth Management Canada Revealed

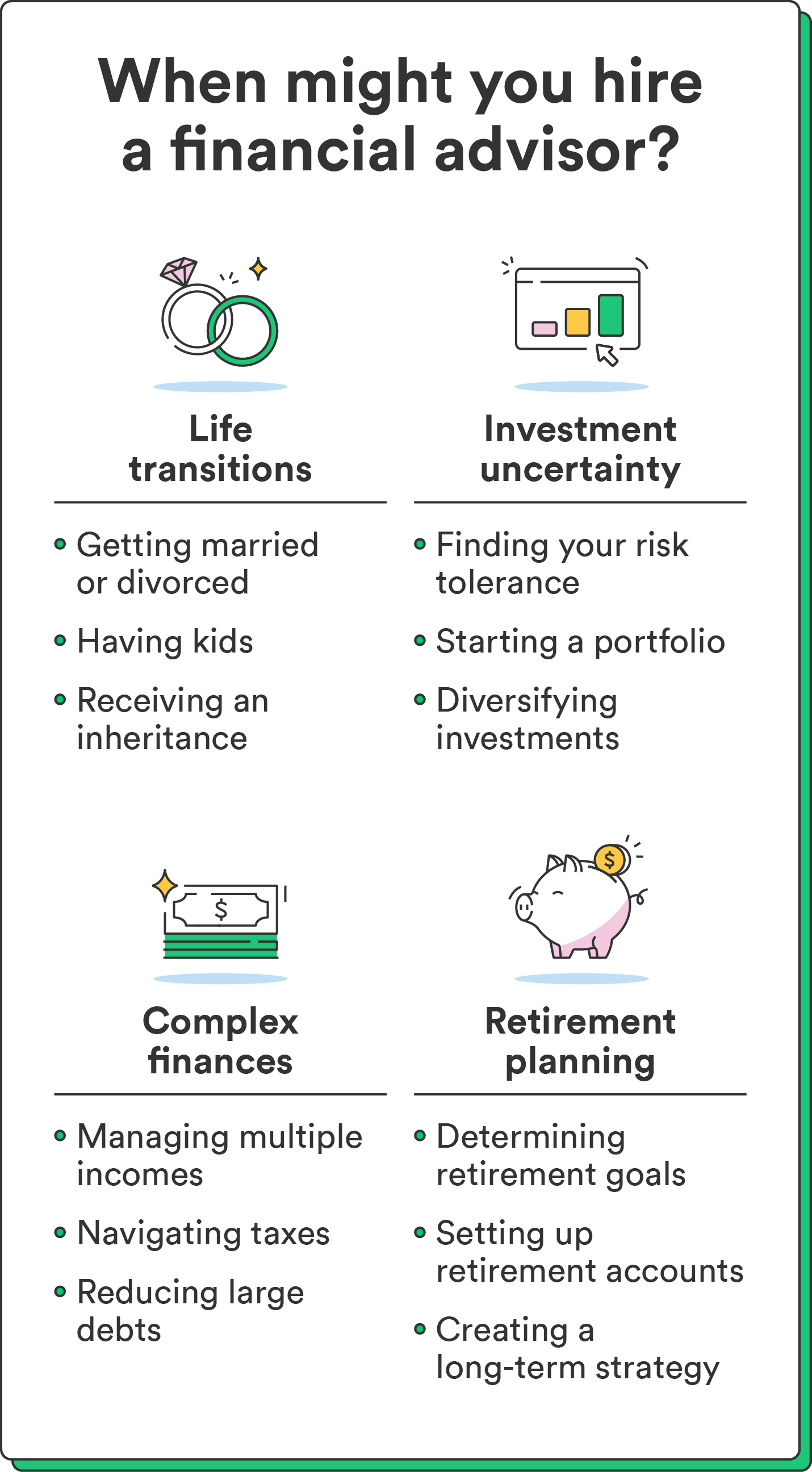

Tune in to this particular article whenever you listen to the expression financial expert, what one thinks of? Many think of a specialist who is going to give them economic guidance, specially when it comes to investing. That’s a great starting point, however it doesn’t paint the complete photo. Not even near! Economic experts enables people who have a number of other money goals too.

A monetary specialist makes it possible to develop wealth and protect it when it comes down to long lasting. Capable calculate your future monetary needs and strategy tactics to stretch the pension savings. They are able to additionally counsel you on when to begin making use of personal safety and making use of the income inside your retirement records to abstain from any unpleasant charges.

Some Known Details About Investment Representative

They can assist you to determine just what mutual resources tend to be right for you and explain to you how-to control to make the most of assets. They are able to in addition let you see the threats and exactly what you’ll have to do to accomplish your goals. A practiced investment expert can also help you remain on the roller coaster of investingeven as soon as your financial investments take a dive.

They may be able provide you with the assistance you should develop an idea so you're able to make fully sure your desires are carried out. While can’t put an amount label regarding assurance that is included with that. Relating to a recent study, the average 65-year-old few in 2022 should have around $315,000 conserved to cover healthcare expenses in pension.

Facts About Private Wealth Management Canada Uncovered

visit this page Given that we’ve reviewed exactly what economic experts would, let’s dig in to the different types. Here’s an effective guideline: All monetary coordinators tend to be economic advisors, yet not all analysts tend to be coordinators - https://www.blogtalkradio.com/lighthousewm. A financial planner focuses on helping folks develop plans to achieve lasting goalsthings like starting a college investment or preserving for a down repayment on a house

So how do you understand which economic advisor is right for you - https://soundcloud.com/lighthousewm? Here are a few things you can do to be sure you’re hiring the proper person. What now ? when you have two bad choices to select? Easy! Find a lot more choices. The more solutions you have, the more likely you're to produce a good decision

The Greatest Guide To Lighthouse Wealth Management

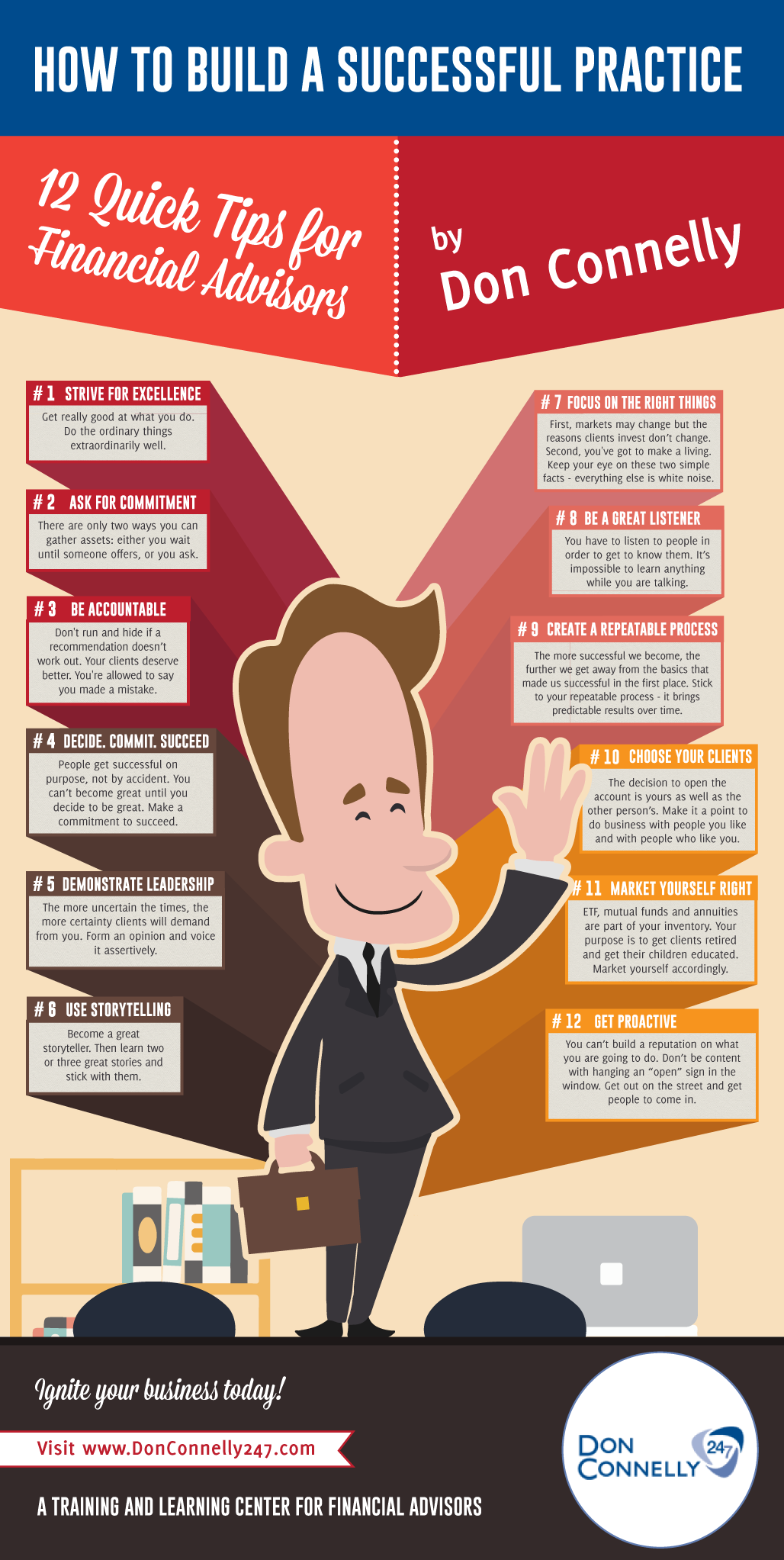

Our very own Smart, Vestor program makes it simple for you by revealing you doing five economic analysts who is going to serve you. The best part is actually, it's completely free attain linked to an advisor! And don’t forget to come calmly to the interview ready with a list of concerns to ask in order to find out if they’re a great fit.But listen, simply because a consultant is wiser than the typical keep does not provide them with the legal right to reveal what to do. Sometimes, analysts are loaded with themselves since they have significantly more degrees than a thermometer. If an advisor begins talking-down for you, it’s time and energy to show them the door.

Just remember that ,! It’s essential that you as well as your financial specialist (anyone who it eventually ends up getting) are on exactly the same web page. You desire a consultant that has a long-lasting investing strategysomeone who’ll motivate one keep spending consistently perhaps the market is upwards or down. financial advisor victoria bc. You additionally don’t wanna utilize somebody who pushes one invest in a thing that’s as well risky or you are uncomfortable with

Get This Report about Independent Financial Advisor Canada

That combine offers the diversification you should successfully spend when it comes to long term. Because research financial analysts, you’ll probably run into the word fiduciary task. This all indicates is any expert you hire has got to act in a way that benefits their customer and never their own self-interest.Report this wiki page